The impending Obama administration decision on the Keystone XL Pipeline, which would tap into the Athabasca Oil Sands production of Canada, has given rise to a vigorous grassroots opposition movement, leading to the arrests so far of over a thousand activists. At the very least, the protests have increased awareness of the implications of developing the oil sands deposits. Statements about the pipeline abound.

Jim Hansen has said that if the Athabasca Oil Sands are tapped, it’s “essentially game over” for any hope of achieving a stable climate. The same news article quotes Bill McKibben as saying that the pipeline represents “the fuse to biggest carbon bomb on the planet.” Others say the pipeline is no big deal, and that the brouhaha is sidetracking us from thinking about bigger climate issues. David Keith, energy and climate pundit at Calgary University, expresses that sentiment here, and Andy Revkin says “it’s a distraction from core issues and opportunities on energy and largely insignificant if your concern is averting a disruptive buildup of carbon dioxide in the atmosphere”. There’s something to be said in favor of each point of view, but on the whole, I think Bill McKibben has the better of the argument, with some important qualifications. Let’s do the arithmetic.

Jim Hansen has said that if the Athabasca Oil Sands are tapped, it’s “essentially game over” for any hope of achieving a stable climate. The same news article quotes Bill McKibben as saying that the pipeline represents “the fuse to biggest carbon bomb on the planet.” Others say the pipeline is no big deal, and that the brouhaha is sidetracking us from thinking about bigger climate issues. David Keith, energy and climate pundit at Calgary University, expresses that sentiment here, and Andy Revkin says “it’s a distraction from core issues and opportunities on energy and largely insignificant if your concern is averting a disruptive buildup of carbon dioxide in the atmosphere”. There’s something to be said in favor of each point of view, but on the whole, I think Bill McKibben has the better of the argument, with some important qualifications. Let’s do the arithmetic.

There is no shortage of environmental threats associated with the Keystone XL pipeline. Notably, the route goes through the environmentally sensitive Sandhills region of Nebraska, a decision opposed even by some supporters of the pipeline. One could also keep in mind the vast areas of Alberta that are churned up by the oil sands mining process itself. But here I will take up only the climate impact of the pipeline and associated oil sands exploitation. For that, it is important to first get a feel for what constitutes an “important” amount of carbon.

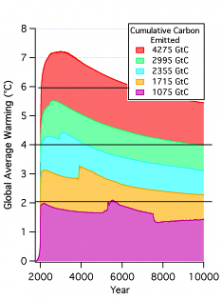

That part is relatively easy. The kind of climate we wind up with is largely determined by the total amount of carbon we emit into the atmosphere as CO2 in the time before we finally kick the fossil fuel habit (by choice or by virtue of simply running out). The link between cumulative carbon and climate was discussed at RealClimate here when the papers on the subject first came out in Nature. A good introduction to the work can be found in this National Research Council report on Climate Stabilization targets, of which I was a co-author. Here’s all you ever really need to know about CO2 emissions and climate:

- The peak warming is linearly proportional to the cumulative carbon emitted

- It doesn’t matter much how rapidly the carbon is emitted

- The warming you get when you stop emitting carbon is what you are stuck with for the next thousand years

- The climate recovers only slightly over the next ten thousand years

- At the mid-range of IPCC climate sensitivity, a trillion tonnes cumulative carbon gives you about 2C global mean warming above the pre-industrial temperature.

This graph gives you an idea of what the Anthropocene climate looks like as a function of how much carbon we emit before giving up the fossil fuel habit, without even taking into account the possibility of carbon cycle feedbacks leading to a release of stored terrestrial carbon  The graph is from the NRC report, and is based on simulations with the U. of Victoria climate/carbon model tuned to yield the mid-range IPCC climate sensitivity. Assuming a 50-50 chance that climate sensitivity is at or below this value, we thus have a 50-50 chance of holding warming below 2C if cumulative emissions are held to a trillion tonnes. Including deforestation, we have already emitted about half that, so our whole future allowance is another 500 gigatonnes.

The graph is from the NRC report, and is based on simulations with the U. of Victoria climate/carbon model tuned to yield the mid-range IPCC climate sensitivity. Assuming a 50-50 chance that climate sensitivity is at or below this value, we thus have a 50-50 chance of holding warming below 2C if cumulative emissions are held to a trillion tonnes. Including deforestation, we have already emitted about half that, so our whole future allowance is another 500 gigatonnes.

Proved reserves of conventional oil add up to 139 gigatonnes C (based on data here and the conversion factor in Table 6 here, assuming an average crude oil density of 850 kg per cubic meter). To be specific, that’s 1200 billion barrels times .16 cubic meters per barrel times .85 metric tonnes per cubic meter crude times .85 tonnes carbon per tonne crude. (Some other estimates, e.g. Nehring (2009), put the amount of ultimately recoverable oil in known reserves about 50% higher). To the carbon in conventional petroleum reserves you can add about 100 gigatonnes C from proved natural gas reserves, based on the same sources as I used for oil. If one assumes that these two reserves are so valuable and easily accessible that it’s inevitable they will get burned, that leaves only 261 gigatonnes from all other fossil fuel sources. How does that limit stack up against what’s in the Athabasca oil sands deposit?

The geological literature generally puts the amount of bitumen in-place at 1.7 trillion barrels (e.g. see the numbers and references quoted here). That oil in-place is heavy oil, with a density close to a metric tonne per cubic meter, so the associated carbon adds up to about 230 gigatonnes — essentially enough to close the “game over” gap. But oil-in-place is not the same as economically recoverable oil. That’s a moving target, as oil prices, production prices and technology evolve. At present, it is generally figured that only 10% of the oil-in-place is economically recoverable. However, continued development of in-situ production methods could bump up economically recoverable reserves considerably. For example this working paper (pdf) from the National Petroleum Council estimates that Steam Assisted Gravity Drainage could recover up to 70% of oil-in-place at a cost of below $20 per barrel *.

Aside from the carbon from oil in-place, one needs to figure in the additional carbon emissions from the energy used to extract the oil. For in-situ extraction this increases the carbon footprint by 23% to 41% (as reviewed here ) . Currently, most of the energy used in production comes from natural gas (hence the push for a pipeline to pump Alaskan gas to Canada). So, we need to watch out for double-counting here, because our “game-over” estimate already assumed that the natural gas would be used for one thing or another. A knock-on effect of oil sands development is that it drives up demand for natural gas, displacing its use in electricity generation and making it more likely coal will be burned for such purposes. And if high natural gas prices cause oil sands producers to turn from natural gas to coal for energy, things get even worse, because coal releases more carbon per unit of energy produced — carbon that we have not already counted in our “game-over” estimate.

Are the oil sands really the “biggest carbon bomb on the planet”? As a point of reference, let’s compare its net carbon content with the Gillette Coalfield in the Powder river basin, one of the largest coal deposits in the world. There are 150 billion metric tons left in this deposit, according to the USGS. How much of that is economically recoverable depends on price and technology. The USGS estimates that about half can be economically mined if coal fetches $60 per ton on the market, but let’s assume that all of the Gillette coal can be eventually recovered. Powder River coal is sub-bituminous, and contains only 45% carbon by weight. (Don’t take that as good news, because it has correspondingly lower energy content so you burn more of it as compared to higher carbon coal like Anthracite; Powder River coal is mined largely because of its low sulfur content). Thus, the carbon in the Powder River coal amounts to 67.5 gigatonnes, far below the carbon content of the Athabasca Oil Sands. So yes, the Keystone XL pipeline does tap into a very big carbon bomb indeed.

But comparison of the Athabaska Oil Sands to an individual coal deposit isn’t really fair, since there are only two major oil sands deposits (the other being in Venezuela) while coal deposits are widespread. Nehring (2009) estimates that world economically recoverable coal amounts to 846 gigatonnes, based on 2005 prices and technology. Using a mean carbon ratio of .75 (again from Table 6 here), that’s 634 gigatonnes of carbon, which all by itself is more than enough to bring us well past “game-over.” The accessible carbon pool in coal is sure to rise as prices increase and extraction technology advances, but the real imponderable is how much coal remains to be discovered. But any way you slice it, coal is still the 800-gigatonne gorilla at the carbon party.

Commentators who argue that the Keystone XL pipeline is no big deal tend to focus on the rate at which the pipeline delivers oil to users (and thence as CO2 to the atmosphere). To an extent, they have a point. The pipeline would carry 500,000 barrels per day, and assuming that we’re talking about lighter crude by the time it gets in the pipeline that adds up to a piddling 2 gigatonnes carbon in a hundred years (exercise: Work this out for yourself given the numbers I stated earlier in this post). However, building Keystone XL lets the camel’s nose in the tent. It is more than a little disingenuous to say the carbon in the Athabasca Oil Sands mostly has to be left in the ground, but before we’ll do this, we’ll just use a bit of it. It’s like an alcoholic who says he’ll leave the vodka in the kitchen cupboard, but first just take “one little sip.”

So the pipeline itself is really just a skirmish in the battle to protect climate, and if the pipeline gets built despite Bill McKibben’s dedicated army of protesters, that does not mean in and of itself that it’s “game over” for holding warming to 2C. Further, if we do hit a trillion tonnes, it may be “game-over” for holding warming to 2C (apart from praying for low climate sensitivity), but it’s not “game-over” for avoiding the second trillion tonnes, which would bring the likely warming up to 4C. The fight over Keystone XL may be only a skirmish, but for those (like the fellow in this arresting photo ) who seek to limit global warming, it is an important one. It may be too late to halt existing oil sands projects, but the exploitation of this carbon pool has just barely begun. If the Keystone XL pipeline is built, it surely smooths the way for further expansions of the market for oil sands crude. Turning down XL, in contrast, draws a line in the oil sands, and affirms the principle that this carbon shall not pass into the atmosphere.

* Note added 4/11/2011: Prompted by Andrew Leach’s comment (#50 below), I should clarify that the working paper cited refers to recovery of bitumen-in-place on a per-project basis, and should not be taken as an estimate of the total amount that could be recovered from oil sands as a whole. I cite this only as an example of where the technology is headed.

Omni, Might I suggest another related curve to look at: Investment in renewables as a function of fossil fuel price. As long as fossil fuels were cheap, we did bupkes wrt developing alternatives. We just got fat (literally) and happy (not so literally) and bought more worthless junk.

This argues that we need to increase the price even more! At the very least, fossil fuels should reflect their true cost, including environmental degradation. The proceeds can be used to develop renewable energy–and the concommitant infrastructure–more quickly so that we need not deplete reserves before it is finished.

#146–Scale of the problem–oh, yeah:

http://en.wikipedia.org/wiki/File:Annual_electricity_net_generation_in_the_world.svg

and

http://en.wikipedia.org/wiki/File:World_Energy_consumption.png

Which is why we can’t be “waiting for the world to change.”

“With the current price structure, the waste makes sense for individual agents trying to make a quick buck. That’s why the price structure needs to be changed. And that’s not a technical issue. It’s a political issue.”

Very well said, IMO.

By the way, a sad milestone–I’ve commented several times on Beacon Energy’s flywheel storage technology here. But last week they filed for Chapter 11 protection; their attorney said that the Solyndra fiasco had caused private funding to dry up more or less completely. It’s really too bad, as their first 20 MW plant is up and running and earning, and they had a couple of good contracts in the bag.

But, current share price: $.10.

#141 re raypierre comment

It is a strange notion that coal might run out in 100 years. This has to be based on ignorance, and this was thoroughly dispelled by the recent USGS study of the Gillette field of the Powder River Basin.

That field alone contains 1000 years supply at current rates of consumption. The only limit is the market price of coal, which determines whether it is worth the trouble to scrape off greater amounts of dirt.

But this is only one field of a large region that goes from Wyoming, across Montana and into Canada. If the dragline gets too big, they can go on to shallower fields until the price goes up enough. Coal is so abundant that over half its cost to the user is the cost of its transportation to the power plants.

Of course, the transportation cost will be eased by the enhanced ‘smart’ grid infrastructure, which will enable mine-mouth power plants, skipping the railroad part. The great enamoured feelings for grid improvements from DOE need to be given a little scrutiny.

We need to anticipate plug-in SUVs of the Yukon, Escalade body form, and bigger, since there is no limit to the energy source. And of course the plug-in Yukon will be rated at about 40 MPGE by the EPA. Who can get upset by that – – uh unless they are really concerned about the climate.

[Response: “Current rates of consumption”? Would that we could assume that rates of consumption would stay fixed at the current rate. That would actually solve a lot of problems. The 100 year figure is based on rates of growth of carbon emissions; the growth rate has been pretty steady over the past 100 years. Can new mining and generation capacity actually sustain that rate of growth for another 100 years? I have no idea, but the energy demand at the end of that isn’t ridiculous, since it’s similar to what you get if you bring the entire world up to the current US percapita consumption level. If you doubt that scenario, you have to believe that growth either abates, or that growth of prosperity decouples from energy growth (a consummation devoutly to be wished) –raypierre]

@115 Holly,

I am trying to figure out if you are someone who believes themselves to be more intelligent than the rest of us – hence the comment about it being “imported” from Canada, or if you intended that as a serious remark.

If you cannot differentiate between oil from Canada and that from certain other parts of the world, what makes you think someone would give consideration to your opinion on any other subject?

#139 Brad Neufeld,

Thanks for the info Brad. In addition to being very informative, I was struck by the lack of a smart ass response from Raypierre. I guess when I asked what was the big deal if Canadian tar sands oil replaced that from Venezeula, Saudi Arabia or Nigeria, I receivdd the simplist response – no it will just get burned somewhere else. I have to wonder if there is any point in having a discussion with someone who dismisses a question or another point of view in such a manner.

Raypierre,

You may not be aware of this but global per capita energy consumption has actually been on a slight downward trend bewteen 1979 and 2003 (source: BP). The dates are cherry-picked of course and we can now dismiss this trend. But the stagnation in per capita energy use was real and it basically lasted from 1973 to the point around 2002 at which China’s growth put per capita global energy use back on a rising trend. In contrast with the post-war boom, energy use was obviously decoupled from whatever metric you might want to use for prosperity during that period.

Efficency gains come easy on the back of a long period of cheap energy in which gross waste has flourished.

[Response: Yes, one can hope that the downward trend in per capita energy use resumes, particularly if due to an increase in efficiency or structural change in the economy away from activities that are energy intensive. China itself made considerable strides in that period in reducing the carbon intensity of their economy (tonnes C per $ GDP), though the effect of that was overwhelmed by the growth of the economy. –raypierre]

#155 timg You are aware that Canada is a separate country from the US, aren’t you? Therefore it would still be imported oil. What is your problem with me pointing that out?

If you have been listening to the “ethical oil” arguments that Canadian oil is somehow better than oil from Saudi Arabia or wherever, I can tell you that such arguments are dishonest and fallacious, and I am familiar enough with the people pushing that argument to doubt that they know anything about practicing ethics or honesty.

For your information here is some information about the idea of “ethical oil” with links to much more:

http://deepclimate.org/2011/10/25/the-ethical-oil-institute-on-oil-sands-

http://deepclimate.org/2011/09/01/the-institute/emissions/

#154 and inline–

Well, things aren’t quite so cut and dried supply side as Jim indicates. According to the study referenced, Powder River has about 650 times *US* annual capacity IF you include all the reserves up to and including coal categorized as “hypothetical.” (About 400 billion short tons of the 650 total are classed as either “hypothetical” (42 billion) or “inferred” (367 billion.)) And the US exports something like 10% of its production.

Moreover, the USGS estimated that less than 50% is economically extractable even at $60/ton. (Powder River coal was going for $14.15 on November 4, 2011.) “In August 2008, the USGS. . . concluded that at the time of the economic evaluation, only 6 percent of the original resource, or 10.1 billion short tons of coal, was currently economically recoverable.”

So, let’s say 10% is recoverable; that would be 65 years worth of coal assuming that domestic consumption stays constant. Allow 10% more yearly for export, that’s 65/1.1 = 60 years worth. At least, the idea of 100 year’s worth of coal–economically extractable coal; as Jim says, the market price is determinative–isn’t obviously wrong.

Nor is the Powder River Basin is just “another field”: “In 2007, the Powder River Basin alone produced 436 million short tons (396 million tonnes) of coal, more than twice the production of second-place West Virginia, and more than the entire Appalachian region.” There are other fields in the West, but with lower-value coal, or less of it. The coal in western Canada, for example, is mostly lignite.

Clearly this topic is bedeviled with definitional questions, uncertainties, and competing scenarios. But the one thing we know is that the coal had best stay in the ground. Demand has been dropping over the last few years, but that’s not likely to be enough. Costing emissions honestly is what we really need to make sure that that coal does (mostly) stay put.

#158

The first link works, but not the second.

http://deepclimate.org/2011/10/25/the-ethical-oil-institute-on-oil-sands-emissions/

http://deepclimate.org/2011/09/01/the-institute/

The endorsement of the “ethical oil” meme by the Canadian and Alberta governments is especially pernicious (I discussed this back in January):

http://deepclimate.org/2011/01/12/ethical-oil/

The two levels of government continue to peddle myth that planned massive expansion of the oil sands is somehow compatible with reduction of GHG emissions.

In fact, Canadian environment minister Peter Kent recently stated that Canada would move towards a decarbonized economy (at an unspecified rate). Nevertheless, he justified “responsible” expansion of the oil sands because fossil fuels “would predominate” the global energy mix “for many decades to come”.

So much for a 50% global cut in GHG emissions by 2050.

Deep Climate #160,

There’s no contradiction between fossil fuels predominating the global energy mix for many decades to come (the most likely scenario) and a 50% cut in global GHG emissions by 2050.

The share of fossil fuels in the global energy mix is so large that if their consumption was cut in half while electricity generation from wind, solar and geothermal increased 20-fold, fossil fuels would still predominate.

Without investment in fossil fuels, emissions would be cut a lot more than 50% by 2050.

Massive investments in “oil sands” would be perfectly compatible with emissions cuts if coal was being phased out in North America. It’s more efficient to replace fossil fuels for electricity generation than for untethered motor vehicles.

What’s not compatible with emissions cuts is to put significant amounts of this oil on the market so soon.

If it was produced for some kind of strategic reserve or if the productive capacity was kept in reserve it would be a different deal. People who claim to care about human rights, independence from Middle-Eastern oil and such but who aren’t arguing for the establishment of a massive reserve are dupes or hypocrites.

Holly,

I see you fit in well here, with your habit of talking down to people. Yes, I know Canada is a separate country. Even had a Canadian roommate in grad school – he’s a prof at UBC now.

I will have to admit to being unfamiliar with “ethical” oil. Sounds like some artificial construct to me. But them I didn’t introduce the term into the conversation. You did.

I asked if you were able to differentiate between sources of oil. Believe it or not, supplying the nation’s energy needs is not all about how much CO2 gets produced. One of those issues is security and reliability of supply. On whom do you think it would be better to rely on – Canada or the Saudi’s?

Of course we wouldn’t have to rely on anyone if we made the decision to increase the percentage of nuclear in the mix. It would also go a long way to solving the CO2 problem, or at least the US’s contribution to the problem. But I’m betting you would disagree.

[Response: This dialog between the two of you isn’t going anywhere useful at this point. Can we just call it quits for this particular line of discussion? I think you’ve both stated your positions. –raypierre]

I can’t help but wonder about the CH4 response to increases in CO2. If we target a doubling of CO2 and calculate from that a 2°C increase then there will be an associated increase in CH4 which again adds to the overall temp increase. I think in the High Permian event the magic number was something like 4°C to trigger the CH4 hydrate that led to a rather dramatic end. But in todays climate system there’s already ~150% increase in CH4. Not good. If that trend continues and we don’t curb CO2 well bellow that doubling to 500ppm then aren’t we likely to hit that dreaded 4°C and illicit the same response from the oceans CH4 hydrate store. Which results in “game over” or at least has in the past?

I love the work your doing on this site and I use it as a reference all the time. I can also understand how for the sake of economy we stick to one subject at a time, however I think there is a distinct link between temp CO2 and CH4 that is by and large inseparable. I can’t help but think we’d also have to extrapolate out the CH4 levels to get very accurate with temp predictions.

[Response: I’d put it a bit more broadly than you do. The big issue is the feedback of temperature (and precipitation) on near-surface organic carbon in permafrost and ocean sediments. That carbon could get oxidized and released as CO2. Or it could get out as CH4. Either way, it’s the organic carbon cycle feedback that has some real dangers. It’s also possible that the terrestrial ecosystem will continue to be a sink of carbon, but with the present state of modeling the land carbon cycle we just don’t know how long that can last. It’s an area where progress can be made, but it may be an even harder problem than clouds. The best reason to be worried about this is the PETM event about 55 million years ago, when some kind of organic carbon release occurred in the context of an already warming climate. –raypierre]

Ray, In your post you say that the Keystone, at 500,000 barrels per day, “adds up to a piddling 2 gigatonnes carbon in a hundred years.” If that’s the case, 95 Keystones adds up to a significant 195 gigatones in a hundred years.

But the NY Times, in referencing an Andrew Leach blog, says “It could take 95 Keystone XL pipelines — and until the year 3316 — to release the full amount of carbon in Canada’s oil sands.”

Something is not right here.

[Response: Yes. You can check my arithmetic yourself. (Just did it again and got the same answer) About a hundred pipelines for about a hundred years would release the full carbon. You can do it even more simply just doing the computation in barrels: 1.7 trillion divided by (500000 barrels per day * 365 days) gives 9315 years for 1 pipeline, or 93 years for 100 pipelines. I can’t figure where the “year 3316” could be coming from. I’ll ask Andrew what he had in mind. By the way, while we’re on the subject of a hundred pipelines, note that in order to build 100 you have to build the second one (we already have one), so it’s obvious that if you stop the second one you don’t get the rest either, at least not over the US route. I guess you could sum up McKibben’s strategy that way –raypierre]

[Response: I just heard back from Andrew Leach. Evidently I’m not the only one reading email at midnight. He says that the NYT quote mixed together two different estimates he made. The 95 pipelines figure was for about 100 years, and is consistent with my numbers. The “year 3316,” however was based on an assumption of extraction at a fixed rate of 5 million barrels per day. I am sure a lot of people are as a result going around with the erroneous notion that it would take 95 pipelines more than a thousand years to add up to a serious amount of carbon. –raypierre]

How much CO2 is too much? I have noticed an increase in the price of pecans. According to

http://thinkprogress.org/romm/2011/11/07/363487/a-new-record-14-us-billion-dollar-weather-disasters-in-2011/

it seems that the drought in Texas could have something to do with the price of pecans, and with GW.

Unfortunately this thread is no longer young, but I wanted to mention a couple of things concerning the more recent thinking of defining a sensitivity metric that relates global temperature to emissions rather than to atmospheric concentrations. I’d like to see what other people think as well. It’s the latter that matters for the radiation physics, but some of the numbers here might have a bit more meaning to the regular person, especially in light of the recent news that 2010 set the record for global carbon emissions, with large growth coming from the developing world.

I was initially skeptical of the application- the traditional climate sensitivity perspective involves a rather robust simplicity of the forced climate response that relates some forcing F to the global temperature anomaly dT, by S=dT/F (in equilibrium) assuming no large non-linearities or bifurcations within the range of change being considered. However, for the emissions perspective (with a sensitivitySE=dT/E, where E is the emissions), we need to decompose the problem into a term dT/C multiplied by C/E, where C is the change in atmospheric carbon (where E and C have dimensions of mass of carbon). This introduces considerable issues with the carbon cycle response, and still incorporates the uncertainty in climate sensitivity when determining how much emission you need to reach a given temperature target.

The traditional approach already incorporates carbon cycle responses into S (through the definition of F, the final radiative forcing), but information is lost as to how fast a specified concentration target (such a doubling of atmospheric CO2 concentration) is reached, which depends on these carbon feedbacks (that ultimately determine the time dependence of CO2 concentration in terms of sources and sinks). Diagnosing this behavior is of critical importance on policy related timescales.

After reading some of the papers on SE that started to pioneer the idea, I began to grow on it (such as the recent work of Damon Matthews, Solomon et al 2009, and some others which ended up becoming a major theme in the NAS 2010 report). The linearity between global temperature and cumulative emissions was not self-evident to me, and to the extent that it holds over a fairly broad range, there has to be some exciting applications to ancient climates as well as to contemporary policy goals.

The upside is that determining a cumulative emission threshold for a target global temperature increase could be very useful as a tractable and clear metric for policy-makers. This is particularly attractive because ideas like “radiative forcing at the tropopause” can’t really be appreciated outside of the climate community.

There’s also been good steps made in thinking about what we mean in terms of “committed climate warming” in contrasting a scenario where we stabilize atmospheric concentration (implying a ~80% reduction in global emissions, and requiring some heating in the pipeline as the oceans warm enough to accommodate energy balance) vs. a zero emission future scenario (which is what “committed” should mean, since it is only fair to use the past emissions when we say “committed”). In the latter case, it is possible to eliminate future warming in the pipeline, although recent studies show that global temperatures do not decline for centuries to millennium even after atmospheric CO2 begins to decay (though the physical arguments for this involving the deep-ocean seem a bit hand-wavy to me and I think it should be explored more…but it seems to open up the door for a new way of thinking about climate change recovery).

My own calculations put the EROEI of gasoline from Alberta tar sand at around 2:1. I am as horrified by the prospect of oil sands development as anyone. But one thing needs to be considered — the USA must get its oil from somewhere. Big Oil has stalled and sabotaged the transition to alternative energy sources for decades and now the US will finally be paying for it. When the financial system collapses over the next few months likely, the US dollar will inevitably lose its reserve currency status, which means that the US will no longer be able to export worthless pieces of paper in exchange for the importation of valuable real world commodities. This means it will be severely oil stressed, and oh look, just north is all that oil… It’s coming out regardless, whether we like it or not.

I come from a science and engineering background and I don’t think scientists really grasp the gravity of the financial situation facing the globe, and what is about to happen. Unfortunately the vast majority of people still view the world as “economy versus environment”; there is a separation. When the economy collapses, 99% of the people out there, most of whom will be simply trying to eat, will have little sympathy for scientists’ cries over the future of our climate a few decades down the road. The oil industry will take advantage of this situation and try to get away with murder. The US will be getting oil one way or another, and it will likely be taking it by force, from Canada.

If this Keystone pipeline doesn’t go through, then Alberta will be pushing for the alternative market — Asia — and will try to ram through the Northern Gateway pipeline to the west coast, through unimaginably rough terrain, and negotiate supertankers through precarious BC fjords. Oil spills are guaranteed.

I think all effort should be on weaning the USA off oil.

“The US will be getting oil one way or another, and it will likely be taking it by force, from Canada.”

That reminds me of the old (and crass) adage that “one who refuses to resist can’t be raped.” That is, the probability of the Harper government resisting any blandishments from either Big Oil or the US seems vanishingly small–so it seems highly unlikely to me that any force will be required, even if this scenario otherwise plays out exactly as described.

For those of us who see that excess GHG is accelerating humanity’s demise, it would be comforting to believe that stopping Keystone XL meaningfully changes that timetable. But as has been repeatedly pointed out, the problem is demand, not supply.

[Response: But the demand is for energy, including portable energy for transport, not specifically for fossil fuels. Capital will flow to one or another sort of expensive energy production, but it is not written in stone that it will be fossil fuels. Actions like McKibben’s are based on the premise that raising a sufficient ruckus about investment in one particular direction can give cleaner options a chance. I have no idea if that will actually work, but I for one am glad that somebody is giving it a try. The unassailable principle is that almost all of the tar sands oil must stay in the ground, and while I have no particular qualifications to try to make a prediction about the prospects of one or another tactic working (does anybody?) I think I am on firm scientific grounds in proclaiming that one way or another, the carbon had better mostly be left where it is. –raypierre]

raypierre, Help! You look like a man aware of human factors. I’m going to repeat something I have tried to bring up in another thread or two. There appears to be a trend toward more area covered by floods and drought, and even a trend toward bunched precipitation (fewer but stronger events to deliver a greater fraction of the rain or snow that falls on an area) between arid and flooded areas. The looming problem is this: One year between now and 2030, say, both floods and drought may have a ‘big year’. Big as in a famine and a million or more dead people. The cumulative probability of a coincidence grows faster than one might think (recall the coinciding birthdays puzzle).

How can the cumulative probability for n years be estimated? This requires a model study of course, but by not using the slowest model you can get some idea of it pretty soon. Humankind deserves this sort of warning. raypierre, please speak to this question.

Good article, but would “it doesn’t matter much how rapidly the carbon is emitted” apply to both climate change and ocean acidification? Or would faster rates of emission only further overwhelm the ocean’s ability to “neutralize” an excess (possibly contributing to accelerated decline in the “biological pump”)? And is bitumen closer to oil or closer to tar (sorry)? :-)

Raypierre said, ” “Current rates of consumption”? Would that we could assume that rates of consumption would stay fixed at the current rate. ”

Coal to oil and gas are destined to become very cheap.

[Response: Interesting to know that you think so, but could you let us know your reasoning? –raypierre]

#171 Jessen, the government of Alberta unveiled a new information portal about the oil sands/tar sands today, and their Glossary describes bitumen:

“Bitumen – A thick, sticky form of crude oil that is so heavy and viscous that it will not flow unless it is heated or diluted with lighter hydrocarbons. At room temperature, bitumen looks much like cold molasses. It typically contains more sulphur, metals and heavy hydrocarbons than conventional crude oil.”

http://environment.alberta.ca/apps/osip/

The decisions on the pipeline will be delayed for a year or so, as anounced today:

http://www.nytimes.com/2011/11/11/us/politics/administration-to-delay-pipeline-decision-past-12-election.html?_r=1&hp

So all those pipeline protests may have helped, along with the good research by reporters and bloggers. Public pressure can have an effect.

http://blogs.canada.com/2011/11/10/why-president-obama-supports-a-delay-on-keystone-xl-decision/

Breaking! Keystone stopped! for now at least.

http://www.tarsandsaction.org/big-news-won-won/

http://act.350.org/sign/keystone-pledge/

173 Holly Stick,

Thanks for the link to Pres. Obama’s statement.

He seems to be thinking that his administration is on a path to doubling the fuel energy of cars, thus we would not need the additional oil.

Those of us concerned about CO2 should note that the only significant change in ‘fuel economy’ is a deception that could enable electric vehicles to accomplish the goal in the form of the government CAFE standards. The electric vehicles will be given a bonus in the EPA formula for MPGE that approximately triples the efficiency that is actually achieved. Thus, they sound like progress. However, for the CO2 emissions, the electric vehicles will shift their still inefficient real operation to coal fired power sources. Of course this will increase the CO2 emissions associated with operation of such vehicles.

I recently heard that the CAFE calculations will allow manufacturers to count the electric vehicle production twice in the CAFE computations. This further accomplishes nothing but deception about vehicle efficiency.

The President’s view seems to be that none of this will impact the economy since ‘efficiency’ will support growth. Even false efficiency could do this, but the ultimate victim of this kind of efficiency is the atmosphere.

raypierre, economists like Andrew Leach and Michael Levi were fairly critical of this post on twitter, though Levi never commented here, I think.

You might want to check out Levi’s article here which makes some assumptions I wonder about:

“…The first is that there is no hard threshold that signifies safety. The world might end up at 450 ppm and still experience 4 degrees C or more (7.2 degrees F or more) of warming. It might end up at 650 ppm and only experience 2 degrees C (3.6 degrees F) of warming. Climate change is about probabilities. This doesn’t mean that we should gamble with high greenhouse-gas concentrations — but it does mean that we shouldn’t give up just because some particular threshold gets crossed…”

http://www.grist.org/climate-change/2011-11-10-are-we-all-toast-after-2017

[Response: Did you have other economists in mind or did you just mean the two of them? I’m not aware of other economists who have expressed an opinion. I’ve had a rather productive exchange with Andrew Leach, and perhaps that will be aired in public if Andy Revkin sets up a forum for it on DotEarth. For now, let me just say that we agree completely on the numbers, but disagree on whether one can count on economics all by itself keeping most of the carbon in the ground, and on the notion of whether McKibben’s tactic makes a potentially effective contribution to the goal of keeping the carbon there. In a perfect world, we’d have a sensible carbon/energy policy and what Bill is doing wouldn’t be necessary, but the question is what do you do in an imperfect world, and is there room to try more than one thing. As for Levi, I don’t really understand what has gotten him so fussed. He seems to be mainly fussed about the fact that I dared to express the sentiment that maybe there’s something to be said for McKibben’s tactic, despite the fact that about 95% of the post was really about carbon accounting. I really don’t think Levi is any more or less qualified than I am to predict what kind of social movements might succeed. Having seen how poorly the economics profession does at forecasting the future, I’m not very sanguine about his rosy projections that the rate of extraction will remain fairly low. I certainly agree with him that the heart of the matter is attacking demand, but who ever said that McKibben’s tactic precludes that? Finally, I don’t understand what the Levi quote from Grist has to do with my post. I did not say that you give up when you pass the trillion tonne threshold. In fact in the last paragraph I say explicitly that you DO NOT give up, because you still have the job of preventing the next trillion tonnes. The rest of Levi’s quote amounts to “pray for low climate sensitivity,” and is just rotten economics, since expected damages are dominated by the low probability that climate sensitivity is on the very high side, rather than the low probability that climate sensitivity is on the very low side. –raypierre]

[Response: The Levi piece linked above at Grist (reprinted from the Council on Foreign Affairs web site) is not a comment related to Keystone at all, but a comment on the recently released IEA report on lock-in effect of energy infrastructure. I find Levi’s article singularly uninformed and unenlightening. He basically shrugs and says that maybe everything will be all right even if we exceed the target emissions. Well, maybe. He also claims the IEA is wrong about the emissions to 2035 that are compatible with the 2C target, but he doesn’t state his reasoning. I’ll have to check the IEA analysis myself, but it doesn’t take much lock-in effect from infrastructure to commit us to 500 more gigatonnes C by 2035 so I don’t think they are far off (and 500 gigatonnes only buys you a 50-50 chance of staying under 2C). Then Levi shrugs again and says maybe there won’t be so much lock-in because nations may decide to abandon infrastructure. He mentions gas fired power plants, but ignores the IEA’s point, which is that if a lot of coal plants get built, they involve a lot of sunk cost that is hard to write down. Maybe in a panic nations will do that. Well maybe. So don’t just pray for low climate sensitivity, but pray for unusual willingess to write down sunk costs. –raypierre]

Raypierre,

Micheal Levi is an establishment ideologue, not an disinterested thinker. He argues for things like imperial wars.

The CFR he belongs to is not your average think-tank. It’s the premier foreign policy outfit and former senior officials as well as Generals work with it. As you might expect, they are tightly connected with industry, including the fossil fuels industry and the oil majors in particular whose strategies are of course ont entierly irrelevant to the US’ Mid-East policy.

He would no doubt coat it in professional-sounding, politically correct langugage but I can only assume he does not want social movements the establishment doesn’t control to succeed. And I also assume he doesn’t want scientists suggesting that the establishment’s climate policies have been such a disaster that it’s past time for outsiders to rock the boat.

[Response: I was a bit surprised to the virulence of his reaction to what I thought was a fairly innocuous post, but (while I’m not familiar with the nature of the CFR and the extent to which Levi’s views are of a piece with his employers) when it comes to climate issues, I don’t think he’s as much of a villain as all that. He seems to accept the basic science, and even the need to get carbon emissions under control. There does seem to be some disconnect between what he professes to believe about such things, and the sense (or lack thereof) of urgency he conveys. And while he seems to accept the need to reduce emissions, he also seems to throw cold water on just about everything anybody proposes to actually do something about the problem. I don’t know where he stands on carbon taxes. Most economists who accept the basic dimensions of the carbon problem think that carbon taxes are the best way to go; some also think direct investment incentives are also needed. In a Grist-reprinted piece, he once stated that he didn’t see anything wrong with lower gasoline prices for Americans (which would seem to go against the notion of addressing the demand problem through price signals). But more generally, the issue on the table is what to do in an imperfect world, involving a lot of different countries with different priorities and different willingness to do various things. –raypierre]

Raypierre,

The US government does not deny basically incontrovertible science. The US government is however not intent on cutting emissions. So Micheal Levi has to justify that. There’s your “disconnect”.

The US government is also not intent on signing on to a multilateral agreement such as Kyoto. So he has to justify that as well.

Does that make him a “villain”? No. Foreign policy is not about morality. That does make him an ennemy however. Don’t be fooled because he’s smart and reasonable.

If the people of the USA doesn’t throw CFR types out of government, climate policy is heading nowhere, not least because they are extremely unpopular in “a lot of different countries” (and for good reason). I would have thought the past 15 years would have made the need for change clear enough for everyone… but maybe we need to wait 15 more years.

Edward Greisch:

More to the point, increase in the price of peanuts. Pecans are rather a luxury. Weather disasters. Since poor people turn to peanuts this is a double whammy.

raypierre, I did mean just the two economists, sorry for the inexact wording. I follow Leach’s twittering some and have noted that he signified agreement with some of Levi’s articles, but I don’t know much about Levi. His lack of urgency to cut emissions is a problem.

I think Leach does try to correct the numbers used on both sides of the argument. I also think he dismisses some anti-tar sands arguments too easily, but that could be my own prejudice speaking; on the other hand many Albertans are scornful of what they perceive as hippie-type environmentalists.

I agree that the economists probably do not understand the pipeline protest movement, which I think is related to the Occupy movement and others around the world lately. Perhaps the economists expect us to be governed by rational self-interest, which isn’t how real people behave.

I don’t understand the numbers used in climate science or in economics, but I trust the climate scientists to have less of a political agenda than some economists. But I think it would be good to have some dialogue between scientists such as yourself and economists such as Leach.

Andrew Leach did write a blog post giving many reasons for what happened around the pipeline decision; but he still misses the social issues. I would say the main thing is that people basically do not trust the governments to look after their interests, and definitely do not trust the corporations to do so.

http://andrewleach.ca/oilsands/keystone-xl-decision-more-questions-than-answers/#comment-1196

Regulating demand with a carbon price would be the rational thing to do. Too bad the U.S Senate wanted no truck with the rational thing, even when it came riddled in exceptions and larded with pork (Waxman-Markey). IMHO, people are spectacularly missing this point when they criticize the pipeline protesters for going after supply by resisting construction. We know perfectly well what people closed the door on cap-and-trade, what people would pay a carbon tax only when it’s taken from their cold dead hands, and what people are too busy demonizing Jim Hansen to even consider fee-and-dividend. And it ain’t McKibben.

And however much more economic sense top-down carbon pricing makes in the abstract, little has happened over the past twenty years to assuage my suspicion that the abstract is exactly where it was always intended to stay. Some countries have implemented carbon taxes, sort of with training wheels on, but it’s going to take immense political will and capital to raise them to the point where an 80% cut in emissions could become a reality within decades. And mobilizing a social movement around something that makes sense in the abstract — and a tax, at that — is not easy. (Tackling both global warming and the recession by shifting taxes from work to carbon ought to be a smash hit with the public, but somehow isn’t.) I suspect that, should we manage to keep all but a trillion tons of carbon in the ground, a vital role will have been played by protests against specific sites and projects, and the political impetus from such protests mushrooming.

It appears that you have lost this cause. Canada has chosen to send the oil via rail (carbon producer) to China (carbon polluter). Is this new option creating a larger carbon footprint than the pipeline? http://www.energy-daily.com/reports/Canadian_PM_eyes_China_after_US_pipeline_delay_999.html

[Response: Prime Minister Harper’s speculations about what he might want to happen in the future aren’t exactly a foregone conclusion, regardless of what you think about the wisdom of pipeline or exploiting the tar sands. – gavin]

The tar sands/oil sands recoverable reserve possibly may be larger yet:

“…What makes it significant is that Saleski is tapping the Grosmont, a rocky formation that is believed to have 400 billion barrels of bitumen in place, none of which is included in Alberta’s reserves of 170 billion barrels because it hasn’t been proven to be commercially recoverable. Almost all of the province’s reserves are in the sandy clastics formations, the part being harvested by all the oilsands players, including Suncor Energy, Syncrude Canada and Cenovus Energy.

If even 25 per cent of the Grosmont oil is recoverable, it would take Alberta’s reserves to 270 billion barrels, putting the province within spitting distance of Saudi Arabia and Venezuela for the biggest oil pools in the world. OPEC estimated in July that Venezuela had 296.5 billion barrels of crude at the end of 2010 and Saudi Arabia had 264.5 billion…”

http://blogs.calgaryherald.com/2011/11/15/grosmont-production-hints-at-new-oilsands-treasure/

For the “do details matter” department:

Keystone XL isn’t the first big US tap into the tar sand deposit. Two other major pipelines have received Presidential permits to bring tar sand oil across the border and are operational now. The 30 inch Keystone, the first phase of the project Keystone XL is only a part of, got its permit in 2008 and started moving oil across the border in 2010. The 36 inch Alberta Clipper, which is the same size as Keystone XL, got its permit in 2009 and went operational in 2010. Pipelines are discussed in public debate in terms of barrels per day throughput, but capacity can be boosted as demand materializes after they are completed by adding extra pumping stations thus increasing the pressure. It seems the companies talk about their projects in the beginning in terms of about 1/2 or less of the ultimate capacity – the lesser capacity is what they need for the project to be economically viable. A 36 inch line like the Alberta Clipper or the proposed Keystone XL can move more than 1 million bpd.

The effect of delaying or cancelling Keystone XL is more fleshed out as I write, because the project has been delayed.

The pipeline business is structured so any project that is delayed for any reason can be quickly abandoned by the oil producers who were committed to it so new projects can be put together quickly. Producers of oil who had signed up to use Keystone XL are saying they are thinking of backing out and committing to other projects.

The choke point XL would have affected most immediately is inside the US, from Cushing to Houston. Because this part of the line doesn’t cross an international border no Presidential permits are required for replacement projects. Because of limited capacity to move oil from Cushing to Houston, the West Texas Intermediate oil price has been lower than the Brent, a fact that was costing tar sand oil producers billions. A competing proposal to Keystone XL on the Cushing to Houston section, Wrangler, was attracting producers and its owners briefly thought about increasing its size. But yesterday, Wrangler owners bought an empty existing pipeline, the Seaway, which was originally built to move oil from the Gulf up to Cushing that had seen little recent use because of the oil glut up there and announced plans to reverse its flow and up its capacity. This will have a quicker effect on this choke point even than Keystone XL, boosting prices received by tar sand oil producers thus encouraging them even more. The effect on the WTI price was immediate and upwards. The two lines already crossing the border from Canada can be increased in capacity by adding pump stations and increasing the pressure. The CPR is already loading some rail cars in Alberta for shipping right to the Gulf. 700,000 bpd was jury rigged to get oil out of the Bakken in North Dakota and the talk in Alberta is they can move 2,000,000 bpd across the border with rail cars and barges which don’t need Presidential permits. The Northern Gateway pipeline proposal, which is a 36 inch 1,000,000 bpd+ potential going across BC would open up the tar sand deposit to China. The proposal needs to survive determined Native opposition, but if Canada decides the US doesn’t want this oil it seems unlikely Natives could stop it. Only a sustained and determined opposition from the US and the rest of the world could slow down production at the tar sand deposit.

The NYTimes did a piece on a tech development where it has been demonstrated that ionic liquids just stirred into bitumen can effectively separate oil from sand without the big energy input of the processes of today. http://www.nytimes.com/2011/11/15/business/energy-environment/research-offers-hope-for-more-efficient-oil-sand-industry.html

In the is protesting this the way to be most effective department:

If you read Hansen’s argument about why it is necessary to leave coal and tar sand and other unconventional fossil fuels in the ground, it dawns that he’s basically granting a “free pass” to conventional oil. He points out that most of what is left of this is in the Middle East and Russia. There’s no way to stop them from producing it, he says, and because civilization is so tooled up to use this oil, and so dependent on it even if it were to decide to decarbonize on a crash basis, it will be used.

So imagine the citizens of North America suddenly wake up to the climate peril civilization is in. An aroused public here is supposed to stand by while the oil barons of the Middle East and Russia do what they please with what’s left of their fossil resources, while we here, on Hansen’s vision and advice, leave our coal and tar sand oil, and presumably unconventional fracked oil and gas in the ground. It seems unrealistic.

Hansen actually opposed anyone signing the Copenhagen agreement, on the grounds that it wasn’t his plan, i.e. he wants carbon tax and rebate to citizens, even though nothing in Copenhagen would have prohibited Hansen’s own country, the US, from meeting its obligations to reduce emissions any way it chose, i.e, Hansen’s tax way. Hansen’s analysis of why Kyoto failed says it was because it was cap and trade not tax, and he leaves out the minor detail like the US didn’t ratify and China and India were exempt. He also dumps on cap and trade over acid rain in the US because, he says, it “didn’t work”. He’s inconsistent on carbon capture, saying in his papers its the emissions from fossil fuel use we have to worry about, but in many public statements its the fossil fuels that have to be left in the ground, as if carbon capture could not be done. So the guy says don’t use coal or tar sand, don’t sign international agreements unless they’re his cup of tea, nothing could work except his plan, and I look at it and think, the guy is a great climate scientist.

I’m on the side of McKibben and Hansen on Keystone XL, because it does my heart good to see a protest, any protest, that has its focus on climate. But I’m not sure it makes much sense other than as a symbol.

I’ll have a piece online with graphic illustrations of the various pipelines and proposals, entitled, “Keystone XL, one head of the Hydra”, but you’d need to search on that title as it won’t be up at The Energy Collective until tomorrow I’m told.

It must delight neocon energy hawks that the Keystone pipeline’s northern terminus lies at a latitude to conjure with – Fifty-Four degrees and Forty seconds North.

The entire masthead of The Weekly Standard should join Bill McKibben’s forces in demanding that Commander in Chief Obama follow in his Democratic predecessor President Polk’s footsteps by declaring the annexation of the Athabasca tar sands to be the manifest destiny of these United States.

Raypierre:

Please add 39′ 20″ to the preceding latitude, as the Forty in Fifty-four Forty or Fight is minutes , not seconds

As long as you are bringing up the other pipelines, their safety record should also be noted. It’s not good, and disingenuous would be a polite way to describe how they handled it.

Meanwhile, what *is* the matter with developing alternatives? Even without the all-out government push that created the likes of railroads and roads, it has achieved some in the marketplace, and would do much better if carbon products were priced properly and the subsidies moved to clean energy. Why *do* we want to abdicate progress in the name of hundred-year-old resources and planning, even if twiddled in contemporary ways? I know, the answer is obvious, but discussion of politics and lies belongs elsewhere.

The Northern Gateway pipeline would have a difficult time getting through, because there are First Nations who could tie it up in litigation for years, and also because many other BC residents are also apposed to it. They rightfully point out that Alberta might make money from the pipeline, but BC would be stuck with the environmental messes. The blustering, stupid Harper government might try to bully it through, but would probably not be able to overcome the opposition. And if they did, are they also going to guard every kilometre of pipeline from sabotage? The oil industry in Alberta and BC has already had some sabotage so the idea is out there.

Susan, Alberta used to call itself “Sunny Alberta” and we have all sorts of sun and wind that could be used for clean energy. It is insane that most of our electricity comes from coal-burning plants, and that we appear to base our economy on the boom and bust oil industry. There are some large wind farms now.

A hundred years ago every prairie farmhouse had a windmill for its water well. Why don’t they all have at least one windmill and some solar panels? They would not have to worry about NIMBYism for these small improvements. One of my farming relatives looked into having a windmill some years ago and said it would cost him $10,000 I think, but I bet it could be done much more cheaply nowadays.

Coal to oil and gas are destined to become very cheap.

[Response: Interesting to know that you think so, but could you let us know your reasoning? –raypierre]

http://www.wfaa.com/news/gasoline-84801677.html

“We’re improving the cost every day. We started off sometime ago at an uneconomical $17,000 a barrel. Today, we’re at a cost of $28.84 a barrel,” said engineering dean Rick Billo.

http://timesofindia.indiatimes.com/home/opinion/sa-aiyar/swaminomics/Coal-to-oil-A-limited-solution/articleshow/1758412.cms

The cost of converting Indian coal into oil should be around $40/barrel. Note, however, that the output of a CTL plant is not crude oil but refined products, which carry a higher price.

http://zfacts.com/p/420.html

The cost to convert the coal is $25 a barrel, the company says,

http://en.wikipedia.org/wiki/Coal

As oil prices were increasing during the first half of 2009, the coal liquefaction projects in China were again boosted, and these projects are profitable with an oil barrel price of $40.

At under $40 a barrel, coal to diesel is already far cheaper than crude oil to diesel. As the price of coal to liquids technology drops and the price of crude oil increases, it will be very tempting for many countries to develop this resource. It’s hard to resist perhaps a 75% decline in costs, especially when the product can be produced domestically instead of imported (Coal is the most widely distributed fossil fuel)